Is Bitcoin a macro asset?

An excerpt from my new book Exponential Gold

[This is a small excerpt from my new book "Exponential Gold"]:

Bitcoin is a global asset.

As such, it is influenced by a vast number of different variables. Economic data releases by major countries like the US have shown to have a significant influence on the intraday performance of bitcoin as evidenced by Mužić and Gržeta (2022). For instance, the authors have shown that bitcoin’s performance is significantly influenced by major US data releases such as nonfarm payrolls, retail sales, and others.

That being said, Benigno and Rosa (2023) provide statistical evidence for a “Bitcoin-Macro-Disconnect” on an intraday basis. Their analysis concludes that bitcoin appears to be uncorrelated to both monetary and macroeconomic news.

So, there appears to be mixed empirical evidence with respect to whether macro news exert a significant influence on bitcoin.

𝗪𝗵𝗮𝘁 𝗮𝗯𝗼𝘂𝘁 𝗲𝗰𝗼𝗻𝗼𝗺𝗶𝗰 𝗯𝘂𝘀𝗶𝗻𝗲𝘀𝘀 𝗰𝘆𝗰𝗹𝗲𝘀?

Dragosch (2020) has pioneered the analysis of different macro factors on the performance of Bitcoin. He utilised a Principal Component Analysis (PCA) to disentangle different macro expectations inherent in traditional financial market prices across various asset classes.

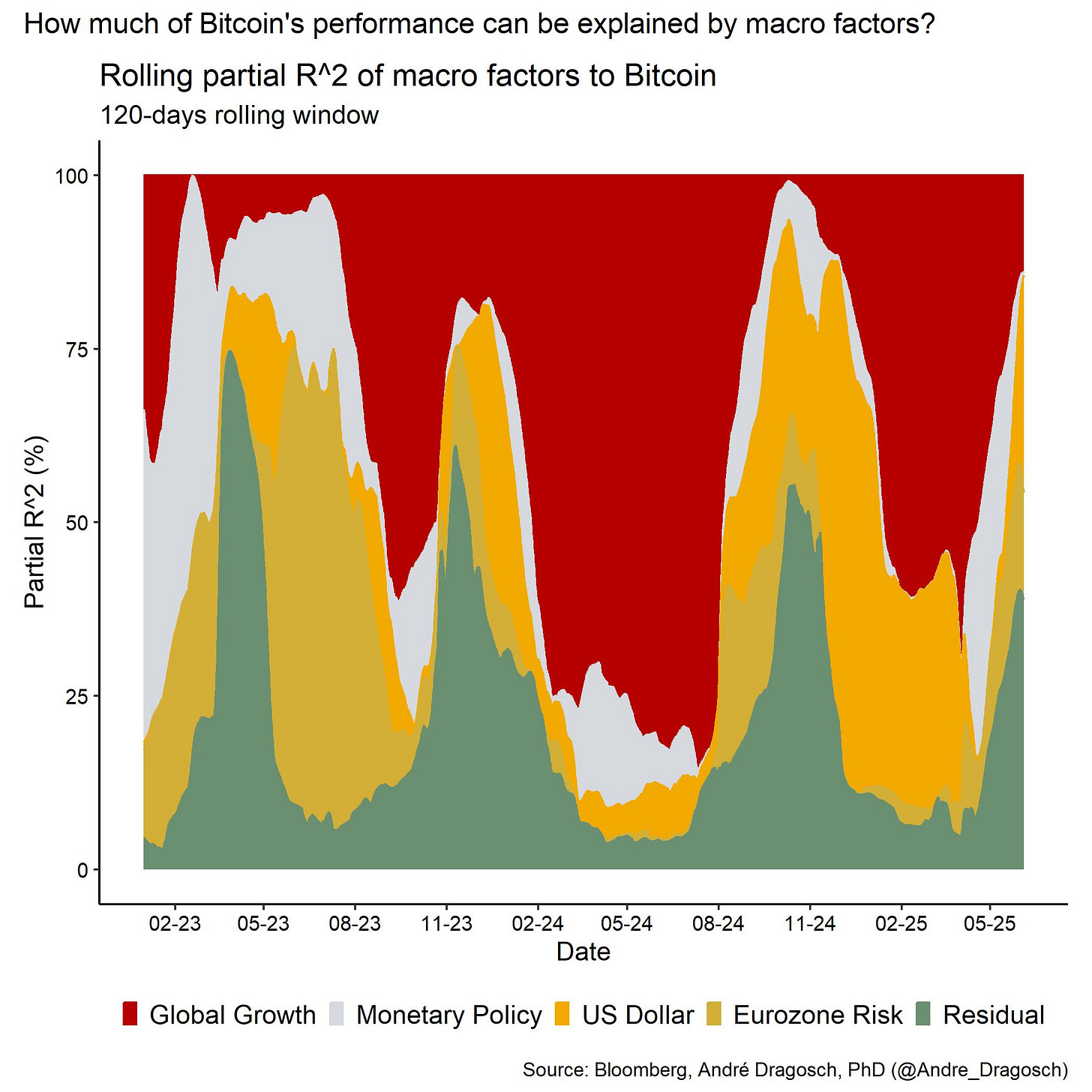

These macro factors are then used to explain historical performance variations of Bitcoin. The result: Based on this analysis, more than 82% of bitcoin’s performance variation can be explained by four major macro factors:

Global growth

Monetary policy

US dollar

Eurozone risks

—> So, the statistical evidence suggests that bitcoin is in fact a “macro asset”.

In this context, it is also worth highlighting that global growth expectations have been the most dominant macro factor for bitcoin, explaining around 45% of bitcoin’s historical performance variation from December 2011 until February 2025. The second most important macro factor for bitcoin appears to be changes in monetary policy expectations which explains another 22% of bitcoin’s performance variation. The following chart shows how much of bitcoin’s performance can be explained by macro factors:

This observation is also consistent with the fact that global growth expectations tend to be highly correlated with changes in cross-asset risk appetite.

Based on further analyses, the average correlation across the full sample from April 2011 to February 2025 is approximately 0.95. In other words, changes in global growth expectations and risk appetite are key to understanding most fluctuations in bitcoin’s price.

From that perspective, bitcoin still appears to be a “risk-on/risk-off” asset for the time being. However, this is likely going to change with increasing adoption and scarcity as well as the structural decline in volatility associated with this over the long term.

It is also worth highlighting that the share of unexplained variation (the “residual”) tends to increase significantly during periods of growth-rate cycle downturns/recessions such as in 2012, 2016, 2020, and 2022 (see chart above).

This implies that bitcoin tends to decouple from standard macro factors during periods of economic calamity, which can increase portfolio diversification.

[End of excerpt]

Thanks for reading!

Hope you enjoyed this excerpt from my new book!

The book Exponential Gold features a foreword by Samson Mow and delivers institutional-grade insights about how to allocate into bitcoin for serious investors.

Stay humble and stack Sats,

André

If you're a professional / institutional investor, this book is for you!

! Get your copy now from Amazon ! 👇

***** Reviews by professional investors so far *****

“A few weeks ago I had the unique opportunity and honor to review a new book by André Dragosch, PhD and what a quality read it was. The book is tailored specifically for institutional investors, and I can confidently say: it’s outstanding.”

— Janina V.

”The book from André Dragosch, PhD is the most precise book on Bitcoin from an investment-perspective I ever read. 100% endorsement on this one.”— Dr. Sven H.

“Great book! I couldn't stop reading it. Very nice historical journey from the beginning of money until what is the core of money today and what might be. Solid micro and macro economic views, all backed by data and charts from reliable sources.”

— Daniel Z.